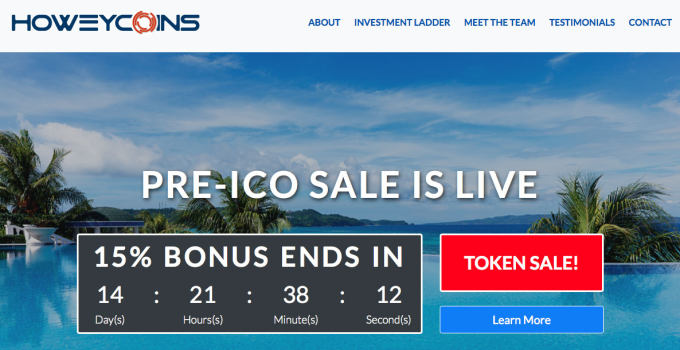

If you exchanged an official email with any SEC employee recently, you have seen the banner for Howeycoins Travel Network. And if you like to get in on a profitable deal, you probably thought, “well, if the SEC is endorsing them, these guys must be legit.” Perhaps you clicked on the banner to see what it was all about. If so, you must have been surprised at what you found.

Pre-initial coin offering deals usually promise spectacular returns, and HoweyCoins are not the exception. The attractive website for the ICO shows alluring scenes from luxury travel destinations. As you scroll down, you will quickly find that HoweyCoins will yield returns of at least 1 percent daily.

If you are not sold yet, the HoweyCoins.com site quickly boasts, “The average registered coin return over a two month period in 2017 was an amazing 72%.”

FINRA Lawyer Blog

FINRA Lawyer Blog