The North American Securities Administrators Association (NASAA) has just released its yearly Enforcement Report. Although NASAA is an international association of all state, provincial and territorial securities regulators in the United States, Canada, and Mexico, the annual report is focused on US jurisdictions.

According to data included in the document, there were more enforcement actions against registered members than against non-registered individuals in 2016.

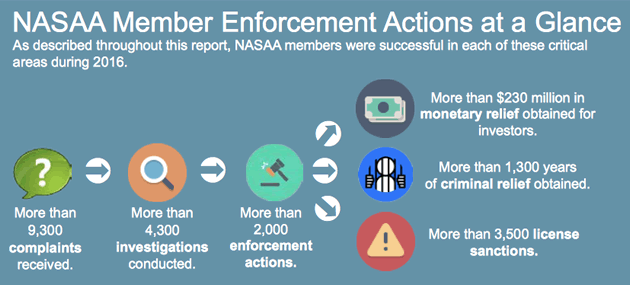

2,017 (or 46%) of the 4,341 investigations conducted by state regulators in the securities industry resulted in enforcement actions. Resulting fines amounted to $682 million, while $231 million were returned to investors. The combined total between fines and restitutions, surpassing $900 million, constitutes a 5-year high.

In 2015, there were more investigations, restitutions to investors were higher ($538 million), and fines were lower (a total of $230 million). The decrease in restitutions can be attributed to the shrinking of investor losses in the bull market economy. The last report included information from 50 jurisdictions, whereas the previous one comprised 52.

Upon the release of the latest report, NASAA President Joseph P. Borg commented, “State securities regulators continue to serve a critical role in protecting investors and holding securities law violators responsible for the damage they cause to individual investors as well as to the integrity of our capital markets.”

Of the 2,017 enforcement actions conducted in 2016, 620 were brought against registered firms and individuals and 604 hit unregistered firms and individuals. The number of investment adviser firms and individuals investigated rose by 30% when compared to the previous year. NASAA’s experts linked the increase to “heightened state interest in individuals and firms who have transitioned from broker-dealer registration to investment adviser registration in recent years.”

According to NASAA Enforcement Section Chair Keith Woodwell, “NASAA members have stepped up efforts to identify and sanction bad actors within the securities industry in order to protect investors and maintain their confidence in the securities markets.”

State securities regulators’ intent to protect investors was affirmed through the withdrawal of 2,843 licenses in 2016, with 657 other licenses revoked, suspended, denied, or conditioned.

NASAA attributed much of its enforcement success to coordination with other state and federal regulators, and emphasized its focus on protecting senior investors. The enforcement actions carried out by state regulators in 2016 involved over 1,000 senior victims, who were primarily defrauded through unregistered securities offerings.

Besides renovating its commitment to protect senior investors, NASAA vowed to counter the threats associated with binary options, cryptocurrency trading, and other emerging financial technologies.

Binary options refer to a bet on the value of an asset only minutes or hours after the option has changed hands. NASAA reported 36 investigations involving binary options across the US last year.

These NASAA numbers show increasing regulatory enforcement. If you or your firm are a target for action, talk to an experienced securities lawyer right away as the regulators are already at work preparing a case against you and there are some defense options open if you act quickly. Call Herskovits PLLC – we focus exclusively on securities law. 212.897.5410 or CONNECT ONLINE

FINRA Lawyer Blog

FINRA Lawyer Blog